One of the machines cost $8,200 and the rest cost a total of $1,800. This GAA is depreciated under the 200% declining balance method with a 5-year recovery period and a half-year convention. Make & Sell did not claim the section 179 deduction on the machines and the machines did not qualify for a special depreciation allowance. The depreciation allowance for 2023 is $2,000 [($10,000 × 40% (0.40)) ÷ 2]. As of January 1, 2024, the depreciation reserve account is $2,000.

Property and Equipment Capitalization

With both bonus depreciation and the Section 179 deduction, any deduction you do not take in the first year is forwarded to the following years. Section 179 doesn’t increase the total amount you can deduct in a single year. Instead, it allows you to benefit from the deduction all at once. To ensure compliance and maximize your tax benefits, it’s essential to address these implications from the onset of the lease agreement. Regularly revisiting your lease arrangements can help you stay aligned with evolving tax codes and make necessary adjustments in your reporting practices. When you’re contemplating acquiring equipment for your business, weighing the advantages and disadvantages of leasing versus purchasing is crucial.

- When a lease does not meet any of these criteria, it’s classified as an operating lease.

- The second quarter begins on the first day of the fourth month of the tax year.

- This excess basis is the additional cash paid for the new automobile in the trade-in.

- You must provide the information about your listed property requested in Section A of Part V of Form 4562, if you claim either of the following deductions.

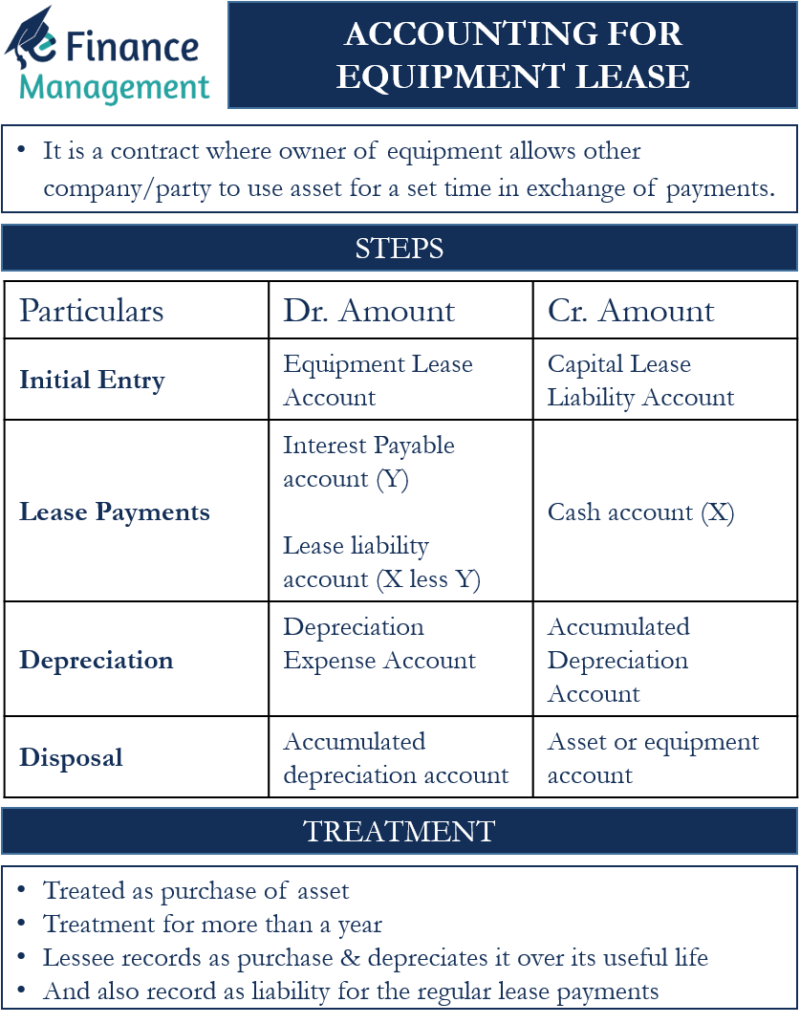

- The lease liability reduction is the remaining portion of the lease payment after accounting for interest.

- By addressing these frequently asked questions, we aim to clarify the complexities of how to account for leased equipment.

Equipment Leasing & Financing

You can carry over to 2024 a 2023 deduction attributable to qualified section 179 real property that you placed in service during the tax year and that you elected to expense but were unable to take because of the business income limitation. Thus, the amount of any 2023 disallowed section 179 expense deduction attributable to qualified section 179 real property will be reported on line 13 of Form 4562. Any cost not deductible in 1 year under section 179 because of this limit can be carried to the next year. Special rules apply to a deduction of qualified section 179 real property that is placed in service by you in tax years beginning before 2016 and disallowed because of the business income limit. See Special rules for qualified section 179 real property under Carryover of disallowed deduction, later. To figure your depreciation deduction, you must determine the basis of your property.

Is depreciation on leased assets allowable?

However, if you are a business owner, the year you claim the deduction depends on the accounting method you use. If you choose to report income and expenses using the cash method, then you can claim the expense in the year you pay for the equipment rental. However, if you use the accrual method, you can only take the deduction in the year you start using the equipment, which may or may not be the same year you pay the rental fee. When considering equipment leasing, businesses must weigh a variety of factors beyond the basic cost of lease payments. Understanding these elements, including depreciation, is critical to making leasing decisions that align with a company’s financial strategy and operational needs. Leasing, most of the time, can offer distinct tax benefits in relation to depreciation and the treatment of lease payments.

Small Business Resources

In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. For more information or to find an LITC near you, go to the LITC page at TaxpayerAdvocate.IRS.gov/LITC or see IRS Pub. 4134, Low Income Taxpayer Clinic List, at IRS.gov/pub/irs-pdf/p4134.pdf. TAS works to resolve large-scale problems that affect many taxpayers. If you know of one of these broad issues, report it to TAS at IRS.gov/SAMS.

You deduct a full year of depreciation for any other year during the recovery period. To help you figure your deduction under MACRS, the IRS has established percentage tables that incorporate the applicable convention and depreciation method. These percentage tables are in Appendix A near the end of this publication.

A conditional sales contract is another term you might encounter when leasing equipment. Under such a contract, the lessee is treated as the owner of the equipment for tax purposes, even though they do not have full ownership until all payments are made. For an operating lease, the equipment cannot be depreciated by the lessee.

However, do not increase your basis for depreciation not allowed for periods during which either of the following situations applies. If you use part of your home as an office, you may be able to deduct depreciation on that part based on its business use. Generally, if you hold business or investment property as a life tenant, you can depreciate it as if you were the absolute owner of the property. However, see Certain term interests in property under Excepted Property, later. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications.

This is a substantial benefit for small businesses looking to minimize their tax burden. One key rule is that the lease must meet certain criteria, such as having a bargain purchase option or transferring ownership at the end of the lease term. If these conditions are met, you can depreciate the leased equipment. HPC hosting revenue in excess of HPC hosting cost of revenue for the nine months ended September 30, 2024 was $1.9 million (12% gross margin). HPC hosting started operations during the fiscal second quarter of 2024.

Land is not depreciable, so Nia includes only the cost of the house when figuring the basis for depreciation. You stop depreciating property when you have fully recovered your cost or other basis. can you depreciate leased equipment You fully recover your basis when your section 179 deduction, allowed or allowable depreciation deductions, and salvage value, if applicable, equal the cost or investment in the property.